Monthly Market Review for July 2021

-Darren Leavitt, CFA

US equity markets forged new all-time highs in July despite fears of a slowdown in global economic growth due to the delta variant of Covid. A bipartisan infrastructure bill made its way through the House and into the Senate for debate in Washington. The Federal Reserve spent the month of July walking a policy tight rope and curtailing June’s hawkish tone. The US Treasury yield curve flattened dramatically, which further fostered the peak growth narrative while at the same time highlighting the current structural issues within the US Treasury market. Second-quarter earnings announcements were much better than expected and helped to aid the equity market’s ascent. Economic data continued to be mixed but was headlined by changes in the labor market and increases in inflation metrics.

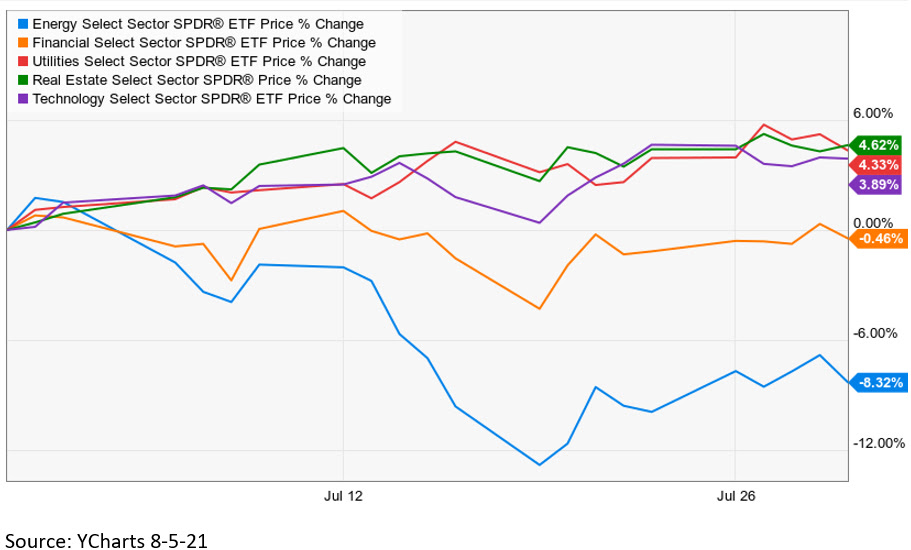

The S&P 500 gained 1.74% for the month, the Dow added 0.87%, the NASDAQ increased 1.03%, and the Russell 2000 lost 4.43%. Defensive sectors led in July with solid showings from Healthcare, Real Estate, and Utilities. Laggards included the Energy sector, which lost 8.82%, and Financials which lost 0.46%. International Developed markets increased 0.53% while Emerging markets were hammered, losing 5.91% due to increased regulatory scrutiny in China and lowered growth expectations related to low Covid vaccination rates in those geographies. The US yield curve flattened over the month as shorter-dated Treasury yields fell less than longer-dated yields. The 2-year note yield fell seven basis points to 0.18%, while the 10-year bond yield shed twenty-one basis points to close the month at 1.24%, the lowest yield since February. Fear that the Fed would make a policy error given the hawkish tone from the June meeting catalyzed the bid into US Treasuries. Additionally, the Fed’s asset purchase program of 120 billion a month coupled with strong domestic and foreign institutional demand kept US Treasuries well bid. This strong demand came when the US Treasury decided to issue less debt, which helped push short-sellers into the market. Gold prices increased by $46.80 to close at $1817.20 an Oz. Oil prices rose fractionally, gaining $0.34 to close at $73.87 a barrel.

At the end of the month, a bipartisan infrastructure bill looked likely to pass the Senate. The bill will add $550 billion in spending to an existing pool of $450 billion, and over eight years could be as big as $1.2 trillion. The plan includes spending initiatives on Roads and Highways, Airports and Ports, Public Transit, Railway infrastructure, Water infrastructure, and Clean waste projects.

Second-quarter earnings announced throughout the month were much better than expected. According to Factset, earnings per share and revenues topped analysts’ expectations 88% or the time. Furthermore, earnings per share were 17.2% higher than expected. However, despite the better than anticipated results, market action post announcements were mixed.

The June Employment Situation Report showed robust job creation with a Non-farm payroll figure of 850K. The July estimate calls for 925k jobs to be created. The Unemployment rate ticked higher in June to 5.9% and is expected to decline to 5.7% in July. The Labor Participation rate continues to be disappointing at 61.3%. Initial Claims and Continuing Claims were better in the front half of the month but regressed in the last two weeks. The Consumer Price index increased 0.9% on a month-over-month basis versus expectations for an increase of 0.7%. The Core CPI, which excludes food and energy, was also higher than expected, coming in at 0.9% versus expectations of 0.6%. At the producer level, the PCE came in a bit lighter than expected at 0.5%, as did the Core number at 0.4%. Retail Sales announced were much better than expected at 0.6% versus a loss of 0.4%. University of Michigan’s Consumer Confidence ticked higher to 81.2 from June’s reading of 80.8. Finally, the Advance Estimate for Q2 GDP fell light of expectations at 6.5%; the street had been looking for 8.2% growth.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.